Quarterly Sterling/Euro Currency Review

Friday 15 January 2010

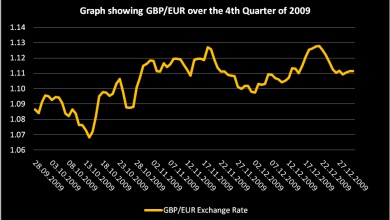

The last quarter of 2009 saw a six cent trading range for the Sterling/Euro currency pair, writes Nicholas Fullerton.

This resulted in around a €15,000 difference on a £250,000 GBP/EUR transaction between the high and low of the quarterly Interbank rates.

If we take some crucial dates from the graph below we can understand what spurred the peaks and troughs.

Whilst this does little to aid accurately predicting future movement it allows us to appreciate why they occurred, and potentially what impact data releases over the first quarter of 2010 may have on the GBP/EUR pairing.

On the 14th October 09 Sterling gained strength and rallied against the Euro. This was derived largely from better than expected UK unemployment data.

The good news obviously shed a positive light on the British Economy. However, one major factor to take into account is that when data is better than anticipated the positive effect is generally amplified.

A day later on the 15th the Sterling charge was bolstered by a report that the Bank of England felt the UK economy was in good shape and considered holding off an extension of the Quantitative Easing programme. From this point Sterling enjoyed a rally gaining almost four cents, rising to 1.1062 by the 23rd October.

Then came the bad news – confirmation from GDP data released that the UK was still in recession. Again, the effect of the release regarding the -0.4% quarter on quarter and -5.2% year on year statistics was exaggerated when absorbed by the market as it had been predicted that the UK was to emerge from the recession. A sharp fall in the value of Sterling ensued and the Euro posted gains.

Improved mortgage approval figures in the UK helped the value of Sterling jump at the end of October and then the GBP/EUR remained fairly range bound throughout the following month.

The November high came on the 18th and saw levels of 1.1270. The buoyancy of the Pound was scuppered almost immediately though by revelations of a 3 way split during the Monetary Policy Committee’s November meeting and not even higher than expected inflation figures released could save Sterling from a 3 cent tumble over the course of the following week.

Although the finances of Dubai dominated economic news at the beginning of December Sterling managed to increase in value against the Euro.

Market concerns, this time surrounding the state of the economies of Portugal, Ireland, Greece and Spain (or the PIGS as they have become affectionately known!) allowed the Pound to advance over the Euro during the first weeks of December. The PIGS continued to hamper the Euro somewhat and largely over shadowed Alastair Darling’s pre budget report.

From roughly the middle of December the markets lacked liquidity and trading was fairly thin as the wind down for Christmas began. This did not stop GBP/EUR reaching the high of the final quarter in 2009 on the 21 December 2009, peaking at 1.1277. The suggestion of interest rates rising in the UK sooner rather than later was the main driver behind the peak.

In summary 2009 was a tough year for the pound, but 2010 will no doubt bring more positive news for the UK economy. Emergence from recession and the likely increase in interest rates would allow Sterling to improve. However the performance of Britain’s currency against the single currency also depends on how the European economies perform.

Nicholas Fullerton

Foreign Exchange Ltd

www.fcexchange.co.uk

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.