Sterling/Euro Exchange Rate Review October 2019

Friday 08 November 2019

Last month, the pound strengthened on Brexit breakthrough hopes, and the Euro weighted under economic concerns, writes currency specialist Ben Scott of Global Reach.

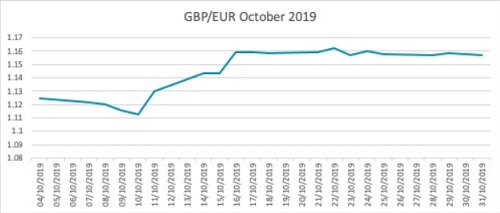

The Pound put in its best monthly performance in more than a decade in October, reaching above €1.30 against the US Dollar and trending in the region of €1.16 versus the Euro.

Unsurprisingly, Brexit was the main market focus when it came to GBP, and by the middle of the month Sterling was rallying on hopes of a Brexit breakthrough.

As October progressed and British Prime Minister Boris Johnson attempted to get his Brexit deal through the Pound was hitting highs on optimism that Brexit would finally make some progress.

The upbeat news also boosted the Euro, as markets hoped that a deal between the UK and EU would help the Eurozone pick up its pace of growth to avoid a recession.

Manufacturing data has been a burden for the Euro this year, printing against a backdrop of a trade war between the US and China which has increased concerns that Eurozone economies could be hit.

October was an interesting month in terms of monetary policy revelations too. Meeting minutes revealed outgoing European Central Bank President, Mario Draghi, decided to push through his latest bout of quantitative easing, against the advice of other officials.

Markets are concerned that objections to the reintroduced stimulus could hinder attempts to increase the scheme if economic data continues to head south.

Draghi’s final press conferences at the end of the month put pressure on the Euro as he reiterated the risks of an economic downturn in the currency bloc — comments compounded further by freshly released weak German data.

Fortunately for the Euro, the start of November has shown some signs of life in German manufacturing.

There have been concerns over the Eurozone’s largest economy, but September managed to show a 1.3% upswing in manufacturing demand. However, the year-on-year figures are still 5.4% lower than the previous year, so it may take several positive readings for worries to ease entirely.

Meanwhile, Christine Lagarde has taken over from Draghi, staying on the same track as her predecessor and reiterating that governments need to do more to help their economies, so the European Central Bank’s stimulus has a chance to be effective and boost the Euro.

While Brexit is paused, the December UK general election is now one of the main focal points for the Pound, with markets viewing the event as largely positive to get the situation moving and eliminate the chance of a no-deal Brexit. Sterling could be sensitive in the lead-up to the event, especially if polls suggest something against market expectations.

As has been the case in previous months, the Pound to Euro exchange rate will likely be sensitive to news headlines, and any more depressed data from the Eurozone could weigh on the common currency further.

If you’d like to make an overseas currency transfer and want to speak to an expert, contact Global Reach on +44 (0)20 7989 0000 or visit Global Reach.

Ben Scott

Global Reach

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.