Sterling/Euro Currency Review Q3 2011

Tuesday 01 November 2011

Sterling traded in a relatively tight range against the euro throughout Q3 2011, but the outlook for the euro looks very uncertain, writes Ben Scott.

Sterling touched a high of 1.1642 (interbank) in September from a low of 1.1056 at the beginning of July 2011. However, it failed to make significant gains against a distressed euro.

Having started positively against the euro, Sterling momentum was lost in the quarter as fears of a double dip recession gripped the UK markets, negating the potential for gains against the crisis hit euro.

The euro then continued to suffer from its crippling debt problems, whilst struggling to deal with the threat of contagion in larger economies, many predicting the breakup of the eurozone in its current form.

Strong Start for Sterling

Q3 2011 started as Q2 had ended with Sterling’s fortunes against the euro being dictated by debt concerns within the eurozone, prompting Sterling gains coming into Q3 as foreign exchange markets’ fixation on interest rate expectations were replaced by concerns surrounding the deepening European debt crisis.

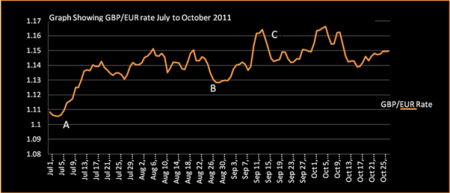

The sharp but short GBP/EUR rise after point A shown on the graph below followed a combination of slightly better than expected economic figures indicating unemployment in the UK had remained relatively steady.

It was further boosted by PMI (Purchasing Managers Index) figures forecasting slightly better than expected growth in the UK economy.

However it was eurozone’s inadequacies and the fundamental failure of European leaders to agree and implement a timely, unanimous and acceptable financial bailout, which was the main contributing factor to euro weakness.

Euro Summit Raised Confidence

Short-term Sterling strength after point A on the graph was abruptly halted as the much anticipated eurozone summit raised confidence that the region would solve its debt problems by uniting in the support of a further €109 billion bailout package for Greece, and, more importantly, by improving the terms and loan rates of the previous bailout packages to 3.5% (from 7.5%).

The euro managed to stabilise in a tight 1.5 cent range against Sterling from mid-July to mid-August, despite comments from ECB (European Central Bank) member Cohene, speaking of the debt crisis, who said ‘Failure to act now risks the euro’s long term existence.’

In the same speech, however, Cohene alluded to the reason behind euro’s stability in this period by saying that the ‘ECB is ready to make major efforts to relieve the situation’, clearly hinting at the policy later adopted, which saw the ECB break from remit to buy significant amounts of Italian and Spanish Bonds (the equivalent of buying their debt to avoid further contagion).

Despite this bringing short-term stability, comments from the Institute of International Finance, Minister Charles Dallara, that the ECB is “stretched by Bond buying”, again highlighted a policy that is a short-term fix to a long-term problem.

Dallara also acknowledged the markets’ growing concerns at the lack of political success and transparency in dealing with the crisis, stating ‘the markets have not seen the conviction, timetable, force and breadth of determination that they are looking for towards fiscal integration.’

The euro outlook will remain bleak as long as concerns remain surrounding the ability of any bailout to remove the risk of financial catastrophe.

It is important to note that the UK’s stance on debt was not called into question throughout this period of global meltdown discussion (in fact the IMF publicly supported the UK austerity measures), much to the relief of Chancellor George Osborne.

Sterling Falls Back

However Sterling finally succumbed to mounting pressure, experiencing further weakness (point B), as focus returned to the UK.

The combination of lethargic UK economic growth, talks of a double dip recession and further quantitative easing (QE), compounded by the long awaited potential interest rate hikes.

At the same time, many economists were now arguing the BOE will not raise interest rates until at least 2013.

Further concerns grew regarding the UK’s exposure to the European debt crisis, as illustrated by Chancellor George Osborne’s apprehensive statement, ‘UK economy is not immune to the debt crisis’.

However, such statements appear to be in observance with policy, keeping Sterling as weak as possible, improving the UK’s export appeal thereby increasing economic activity.

Euro/Sterling Volatility

The sharp trough at point C on the graph is indicative of the instability faced by the euro and the growing belief that policymakers were unable to get a handle on the spiralling debt crisis.

European leaders continued to ‘kick the can down the road’, forcing investors to abandon the single currency in favour of safe haven currencies, which rather bizarrely included Sterling despite the UK’s weak economic outlook.

Euro woes were compounded as a lack of unity and agreement on how to tackle the escalating European crisis resulted in the shock resignation of key ECB policymaker Jurgen Stark, citing his despair over the central bank’s policy of buying government debt as the reason for his departure.

Since the start of October GBP/EUR rates have continued to experience high volatility. The euro started the month on the back foot as Greece admitted it is likely to miss its deficit reduction targets, risking its chances of receiving the next tranche of the bailout package, bringing the potential for debt default ever closer.

However, Sterling strength quickly reversed as the Bank of England shocked the markets on Thursday 6th October by injecting a further £75 billion of QE to stimulate a rapidly deteriorating economy.

Fears of ‘stagnation’ (stagnated growth combined with high inflation) gripped the market, sending Sterling tumbling as concerns grew of a further recession in the UK.

Positive sentiment from the eurozone then bolstered the euro as Chancellor Angela Merkel and President Sarkozy assured the markets that a plan to recapitalise Europe’s bank was coming and that they would provide a conclusion to the Greek debt crisis whilst helping growth in Europe.

The IMF and ECB then provided short-term relief from the debt crisis with the announcement that Greece would receive the next tranche of its bailout in November, despite missing its deficit reduction targets.

Euro Summit

Significant and long overdue relief eventually came for the euro on 26th October on the announcement of an agreement between European leaders to recapitalise European banks and implement a 50% haircut of Greek debt, leading the Greek Prime Minister to proclaim that ‘debt becomes sustainable after today’s deal’.

It is, however, worth noting that after the original Greek bailout it was claimed that Greece would be able to service its debt obligations, something that with hindsight is clearly inaccurate.

The simultaneous announcement of the leverage of the EFSF to €1 trillion was also seen as a positive although experts have forecast for several months that the EFSF would have to be leveraged to €2 trillion to be effective. So concerns remain that the EFSF package may still not be enough.

Respected economist and previous member of the Bank of England Monetary Policy Committee, David Blanchflower, said of the summit agreements, ‘This isn’t going to resolve anything’, suggesting he is completely underwhelmed, and implying the euphoria will wear off quickly as markets accept that European leaders have committed to the absolute minimum, given market expectation surrounding the summit.

Outlook

Going forward, numerous factors will dictate the direction of GBP/EUR exchange rates in the short to medium term.

Indicators suggest the rate will continue to trade within the range seen over the past 4 months, and several key factors from the UK and eurozone could prove instrumental in causing significant breakouts, as illustrated by the recent 20% decline in equities markets as potential recessions in the UK and Europe were factored into market prices.

Concerns continue to grow regarding Sterling’s failure to appreciate in Q3, given the appalling economic conditions throughout the eurozone, the future of the euro still uncertain despite the knee-jerk positivity seen after the initial acclaim of the European debt summit being a success.

Market apprehension as to how successful European leaders will be in implementing the policies agreed at the October 26th debt summit looks set to grow as details surrounding the policies remain minimal.

Weakening economic fundamentals across the eurozone, noticeably Germany, which saw its economy almost grind to a standstill in Q2, combined with credit downgrades for Italy and several French banks, increased strains on the debt burdened eurozone, raising fears that the interest rate increases earlier this year have had detrimental effects on the euro economy.

Concerned financial institutes now estimate that the eurozone will slip back into recession.

Therefore, for all of the obvious concerns currently surrounding Sterling, and despite the resilience displayed by the euro in recent months, it seems evident that the euro is still at risk of a spectacular collapse in the medium term.

Consequently, if the ECB is forced to reverse earlier rate hikes, the euro will lose significant credibility and should push lower as a result.

On a more political level, the retirement of Jean Claude Trichet, the president of the ECB on October 31st, sees the European Central Bank lose a respected president and key policymaker; this could prove very detrimental to the euro.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.