Sterling Euro Review February 2017

Friday 03 March 2017

February may have been the month of love, but the pound failed to woo investors and remained soft against a host of majors, including the euro (GBP/EUR), writes Ben Scott.

The currency pair have both been fuelled by political developments while economic data took a back seat. March looks set to be an incredibly interesting month with Dutch elections and the triggering of Article 50.

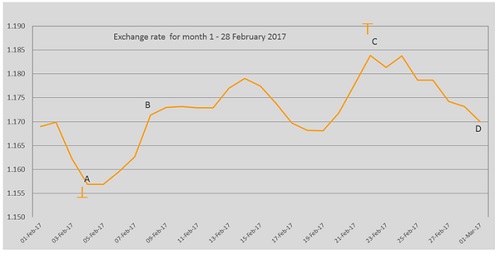

The pound slipped to 1.15 versus the euro at the beginning of February (point A) following the release of the Bank of England (BoE) inflation report. Despite upping growth forecasts, the central bank appeared to be in no rush to hike rates which caused a decline in sterling sentiment.

February saw UK inflation hit its highest level since June mainly attributed to higher fuel costs. Although the inflation reading reached 1.8%, it fell slightly shy of the 1.9% forecasts. Investors in sterling are hoping higher inflation will urge the Bank of England to increase interest rates.

However, the pound soared back to 1.17 after BoE representative Kristen Forbes broke ranks on February 8th (point B) and hinted that the UK may need a rate hike sooner rather than later after a strong string of data. This GBP/EUR shift coincided with rising Greek debt fears.

Brexit and Grexit

The potential of a Greek exit from the eurozone paid little favour to the euro in February. The nation has spent the latter eight years in recession and public debt has been mounting. The start of February saw tensions rise as Greece, once again, looked to be facing a potential Grexit as talks proved unfruitful. The International Monetary Fund (IMF) has suggested that Greece’s debt could become ‘explosive’ in just a matter of decades to reach 275% of its gross domestic product (GDP). Markets have watched Greece come up against multiple deadlines, all harbouring the threat that a deal must be made or funds would fail to be released. February’s hype surrounding the deal played out similarly to others and Greece agreed to further reforms in order to receive much-needed bailout aid. Prime minister Alexis Tsipras stated that it was an ‘honourable compromise’.

Back in Britain, Brexit developments have been ongoing and the start of 2017 has been largely dominated with the Prime Minister’s quest to officially trigger Article 50. The House of Lords refuted the Brexit bill suggesting instead that it needed amendments to protect the rights of EU nationals living in Britain.

May is expected to officially trigger Article 50 at some point in March, but will have to wait to see whether Commons reject the amendment or not before having the freedom to begin Brexit. When the formal proceedings of leaving the EU begin, the pound exchange rate is likely to face extreme volatility, as every development in Britain’s departure could shake markets with some expecting the exchange rate to reach levels below 1.10 interbank.

Pound to Euro (GBP/EUR) Breaks Through Key Technical Level

GBP/EUR broke through a key technical level and reached a two-month peak of 1.1902 very briefly on 22nd February to settle the day at 1.1839 (point C). It was the first time sterling breached this threshold in 2017. The rise came as French politics became more uncertain and controversial political party front-runner Marine Le Pen closed the gap between herself and her rivals.

However, sterling took a slight hit on the release of disappointing UK growth figures. The annualised gross domestic product (GDP) number was revised down for quarter four, from 2.0% to 1.8% and the pound retraced some of it’s impressive gains.

Any positive figures out of Germany in the near future could add fuel to the fire for those that suggest the nation is exploiting the single currency for it’s own gain. February saw German exports grow and boost the eurozone’s trade balance by 6% year-on-year which supported arguments that the nation has an unfair advantage. Additionally, Germany overtook the UK as the fastest growing group of seven (G7) economy in 2016. The nation registered 1.9% growth and also recorded a 1.6% inflation figure – outpacing the US.

Towards the close of the month, the pound was trading above 1.18 versus the euro, but fell back to the region of 1.17 (point D) as news broke that Theresa May was preparing for another Scottish referendum. The surprise news coupled with weak US data allowed the euro to become more appealing.

GBP/EUR Exchange Rate Outlook

As we make our way into spring, the euro exchange rate is becoming somewhat of a wildcard in the markets as politics take centre stage. The beleaguered euro is forecast to become particularly sensitive in the approach to the April 23rd election as far right National Front leader Marine Le Pen may win the first vote bringing us one step closer to a French EU referendum. It’s likely if she does take the crown in the first round that she’ll lose the second, but politics can be unpredictable, despite what the polls suggest. If Le Pen does win, the EUR exchange rate could sink dramatically lower until France’s political landscape has some stability. Euro buyers should stay in contact with their account managers at this time.

Another area of concern for the euro is the upcoming Dutch election which could see Geert Wilders, leader of the euro-sceptic and populist group, Party for Freedom, win. If this were to happen, Wilders would call for a referendum which could see the Netherlands join Britain in departing the EU. Euro investors will be interested in the exchange rate around March 15th when the election takes place.

March will see the release of several pieces of high-tier data that may impact the pound, beginning with UK trade balance figures. Economists have predicted an increase in the deficit, which could be something that weighs on sterling. In addition, unemployment numbers out in the middle of the month could cause some significant market movement if published in line with forecasts. Economists have predicted an increase in unemployment in January from 4.8% to 5.0%. Additionally, something else that may damage the pound is average weekly earnings data. Both including and excluding bonus numbers are expected to dip from 2.6% to 2.5%.

The Bank of England meeting minutes may also be of interest but it’s unlikely the bank rate will shift in March. Inflation data may be another market mover following February’s result – an upswing could help the pound to strengthen as investors price in interest rate rises.

Events that may move the euro in March will be the currency bloc’s growth rate figures and consumer and business confidence data, but the euro and the market is expected to be largely politically dominated.

The US dollar has been strengthening significantly of late and both the pound and euro are expected to fall further as investors price in a Federal Reserve interest rate hike in the near future.

In the long-term, volatility is expected to increase, mainly due to political developments. February raised the possibility of another Scottish Referendum and if this seems set to go ahead the pound could be plagued with softness as details of this are announced. If Scotland were to leave the UK, it could be devastating for sterling.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Cheap Rail Travel in France

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.