Sterling/Euro Review October 2016

Friday 04 November 2016

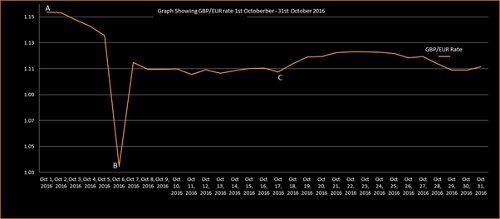

Sterling attempted to find some stability in the month after the 7th October 'flash crash', writes Ben Scott.

Look back to the start of October, many of the data releases were more positive than forecast.

In response, the Bank of England made murmurs that it would not make any further interest rate cuts and the debate about the ongoing necessity for quantitative easing continued.

But Brexit, its implications, and its impact on exchange rates and the financial sector at large, have continued to dominate headlines and column inches throughout the month.

The announcement on 10th Oct that a deadline for Article 50 would be set caused Sterling to fall further.

A Brexit exit deadline was in the process of being set and, while the initial days and weeks post-referendum saw wild flux across the markets, Sterling’s drop on the back of this latest announcement was minimal.

Now, we know there will be a period of up to 6-months before negotiations for the UK’s exit from the EU begins. In this context, the small drop indicated the relative calm of the marketplace.

And just as for previous months, economic data for the UK for the month of October has failed to live up (or down) to the Brexit predictions and subsequent expectations. But economists continue to remind us that this is still early days and ongoing data releases and global events such as the impending US election could trigger further pound slumps.

The pound was attempting to halt declines at the very start of the month. We witnessed GDP data coming in at 0.7% from a previous 0.6% (see point A on the graph).

This halt was, however, a promising direction for the pound because the service sector is the largest part of the UK economy. Looking beyond the UK, the markets also had concerns regarding two main German banks.

Mid-October brought an announcement from Commerzbank that it would be cutting 9,000 jobs. This was closely followed with reports that struggling Deutsche Bank would not be given government aid should the bank find it was close to failing.

Together, these factors were a forceful combination that helped to remove the focus away from the Brexit related news that has dominated headlines and newspaper column inches.

The Brexit news hiatus proved to be short-lived, however, when a 'flash crash' hit Asian markets hard (Point B on the graph).

Of all the possible causes for the crash that have been touted by analysts and journalists, rogue computer trades or an accidental “fat finger” transaction have made headlines.

It is also possible that trading on the back of comments from French President Hollande took place, with the President demanding that the UK be made to pay a heavy price for deciding to leave the EU.

Markets did, however, rebound and trading continued in a relatively tight range from the middle of the month onwards.

Downing Street confirmed comments made by government lawyer James Eadie that it was "very likely" that MPs will be able to vote on the final Brexit agreement reached between the UK and the European Union. The comments were deemed an "encouraging sign" by 'Open Britain' (formerly the 'Remain' campaign), although there was no noticeable market swing.

Data also showed that UK retail sales for September rebounded and consumers were still reaching into their pockets. Inflation figures also came in better than expected at 1% versus 0.7%, limiting the scope for any further interest rate cuts by the Bank of England (BOE) and pushing towards the Bank of England’s target rate of 2%.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Shoe Conversion Chart

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.